Navigating the insurance landscape of ride-sharing apps: ensuring adequate coverage for your vehicle

In today’s gig economy, many individuals, including college students, are turning to ride-sharing apps like DoorDash and Uber to supplement their income. While these platforms offer flexibility and earning potential, it’s crucial to understand the insurance implications of using your personal vehicle for these services.

Most personal auto insurance policies exclude coverage for ride-sharing operations. This means that if you’re involved in an accident while driving for a ride-sharing app, your personal auto insurance may not cover the liability damages.

This is a particular risk for college kids who are signing up to drive for ride-sharing apps. Their parents may not be aware that their personal auto policy doesn’t cover ride-sharing operations. And if the college kid gets into an accident while driving for a ride-sharing app, their parents could be sued for damages.

Understanding Coverage

Personal Auto Policies and Ride-Sharing Exclusions

Your personal auto insurance policy is designed to cover your vehicle for personal use, not for commercial purposes like ridesharing or food delivery. Most personal auto policies contain a “livery exclusion,” which means that coverage is not provided when your vehicle is being used as a taxi or limousine service.

When you activate the ride-sharing app to accept rides or deliveries, your vehicle is considered to be in commercial use. This triggers the livery exclusion, and your personal auto policy will not provide coverage for any accidents or damages that occur while you are actively engaged in ride-sharing activities.

According to a study by the Insurance Information Institute, 70% of rideshare drivers believe they are adequately covered by their personal auto insurance policies.

Ride-Sharing App Coverage and Its Limitations

While ride-sharing apps do offer some insurance coverage for their drivers, it’s important to understand the limitations of this coverage. Typically, ride-sharing app coverage only applies during the period when you are actively transporting a passenger or delivering an order. This means that there is a gap in coverage when you are logged into the app but have not yet accepted a ride or delivery.

Additionally, ride-sharing app coverage typically only provides liability insurance, which means it covers bodily injury and property damage caused to others. It does not cover damage to your own vehicle, which is where your personal auto policy would normally come in.

Potential Financial Pitfalls for Vehicle Owners

If you or your child is using a personal vehicle for ride-sharing or food delivery without proper insurance coverage, you could face significant financial consequences in the event of an accident. If your personal auto policy denies coverage, you could be personally liable for any damages, including medical expenses, property damage, and legal fees.

Protect yourself

To avoid this potential financial pitfall, it’s essential to communicate with your insurance agent about your ride-sharing or food delivery activities. They can assess your needs and recommend appropriate supplementary insurance options.

If you’re thinking about driving for a ride-sharing app, here are a few ways to protect yourself:

- Check Your Personal Auto Policy: Ask your insurance provider if your current policy includes coverage for rideshare driving.

- Understand the gaps: If your policy doesn’t cover rideshare, inquire about potential add-ons or endorsements.

- Review the terms: Understand the coverage limits, exclusions, and conditions of the platform’s insurance.

- Gap insurance: If your personal and platform insurance don’t fully cover you, consider gap insurance to bridge the gap.

- Umbrella insurance: For added protection against significant claims, an umbrella policy can provide extra coverage.

- Stay Informed: Keep track of changes in rideshare insurance regulations and your personal policy.

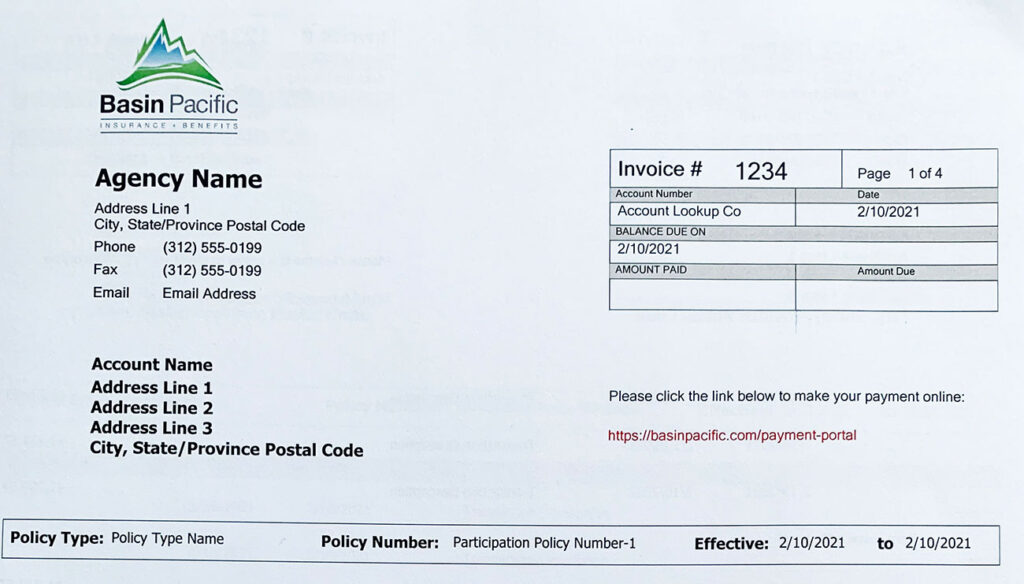

At Basin Pacific, we believe in supporting our local communities. That’s why we’re committed to educating our customers about the risks of ride-sharing and how to protect themselves. If you have any questions about ride-sharing insurance, please don’t hesitate to contact us at [email protected]. We’re here for you.