Are Your Kids Safe Without Renters Insurance?

According to the National Center for Education Statistics, over 19 million students were enrolled in colleges and universities in the United States in fall 2023. That’s a lot of kids heading off to college, and many of them may not have renters insurance.

As a parent, you want to make sure your college student is safe and protected, both on and off campus. One way to do that is to consider getting them renters insurance.

The average renter’s insurance policy for a college student costs around $15 per month.

What is renters insurance?

Renters insurance is a type of insurance that protects your belongings and liability in case of a covered event, such as fire, theft, vandalism, or water damage. It’s relatively inexpensive, and it’s a good idea for anyone who rents a home or apartment—including college students.

The most common types of claims filed by college students are for theft and water damage.

Why do college students need renters insurance?

There are a few reasons why college students may be particularly at risk of a loss covered by renters insurance:

- College dorms and apartments are often targets for theft. College students may have expensive belongings, such as laptops, smartphones, and textbooks. Renters insurance can help replace these items if they are stolen.

- College students may be liable for damage to their rental unit. If a fire or other covered event damages a student’s dorm room or apartment, renters’ insurance can help cover the cost of repairs.

- College students may be sued for injuries or property damage. For example, if a guest slips and falls in a student’s dorm room or apartment, renters’ insurance can help cover the cost of their medical bills or property damage.

How to choose a policy

When choosing a renters insurance policy, it’s important to consider the following factors:

- Coverage: Make sure the policy covers the types of losses that are most likely to affect you. For example, if you live in an area that is prone to flooding, you may want to make sure your policy covers flood damage.

- Cost: Compare quotes from different insurers to find an affordable policy.

- Reputation: Choose an insurer with a good reputation for customer service and claims handling.

Tips for talking to your college student about renters insurance

If you’re a parent, it’s important to talk to your college student about the importance of renters insurance. Here are a few tips:

- Explain the benefits of renters insurance in a way that your student can understand. For example, you can tell them that renter’s insurance can help them replace their stolen belongings or pay for repairs to their rental unit if it is damaged.

- Help your student choose a renter’s insurance policy that is affordable and meets their needs.

- Make sure your student knows how to file a claim if they need to.

Renters insurance is a smart investment for college students. It can help protect them from financial losses in the event of a covered event.

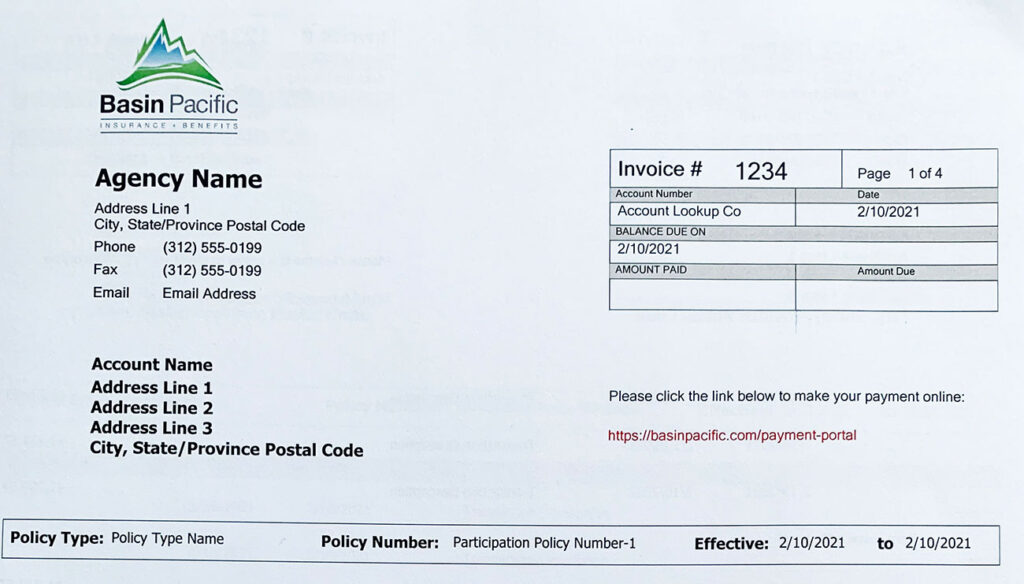

Should you have any questions regarding your current coverage or want further information on renters insurance offered by Basin Pacific Insurance, click here, or contact us at (509) 765-4785.

Thanks for explaining how renter’s insurance can help students protect their assets after a theft incident. I have a friend who wants to invest in an apartment for his niece who wants to enroll in college. I should talk to her about finding an insurance company for this someday.